By Shiloh Nwambueze

Business News Correspondent

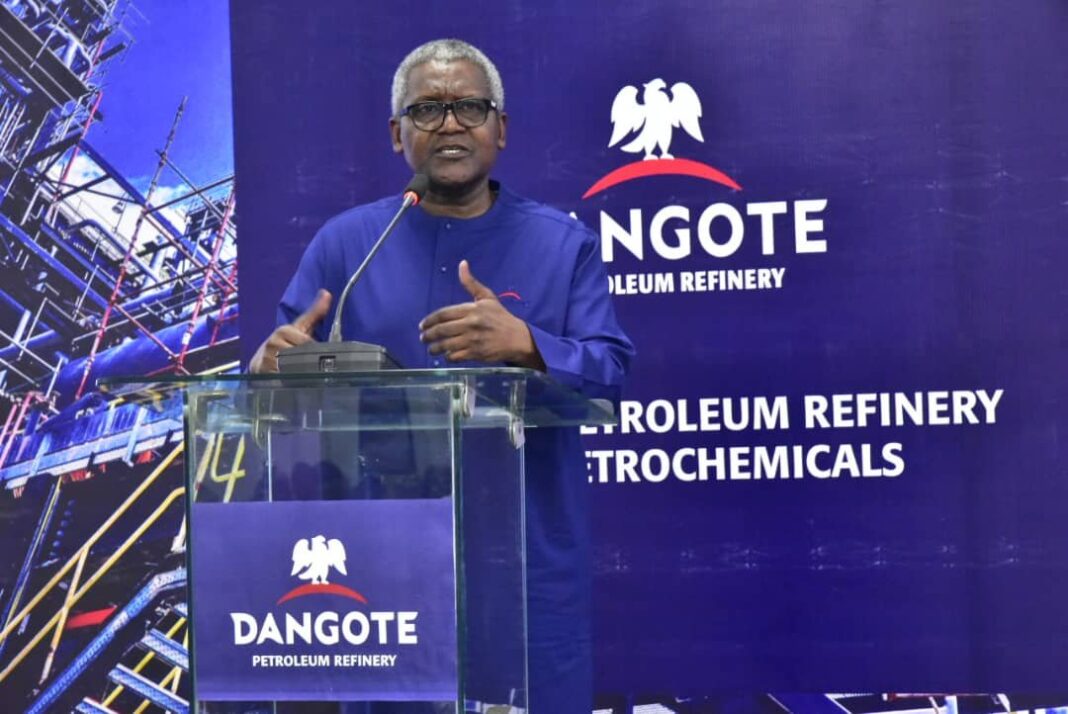

Nigeria’s domestic petrol market received a major lift in November 2025 as output from the Dangote Petroleum Refinery surged significantly, helping to stabilise supply after months of shortages.

Fresh figures from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) show that the refinery increased its daily delivery of petrol to 23.52 million litres, up from 17.08 million litres recorded in October — a sharp jump of 37.7 percent.

Imports Rise Sharply to Support National Stock

Despite Dangote’s increased output, the country still leaned heavily on imported fuel to satisfy demand. Daily petrol imports expanded by over 80 percent, climbing from 28.9 million litres in October to 52.1 million litres in November.

Combined, Nigeria received an average of 71.5 million litres per day in November, a significant improvement compared to the supply slump seen in previous months.

According to NMDPRA, the spike in both local output and imports was necessary to rebuild national reserves that had dropped below safe thresholds in September and October. Several vessels expected earlier were delayed, and their November discharge boosted the month’s volume.

Consumption, Stock Levels and Refinery Status

Nigeria’s average daily fuel consumption for November stood at 52.9 million litres, while national stock sufficiency was estimated at 16.65 days.

However, the report reaffirmed that all four state-owned refineries under NNPC Limited are still idle. The facilities — located in Port Harcourt, Warri and Kaduna — have no confirmed restart dates despite ongoing rehabilitation efforts.

NNPC: Existing Refineries Need Major Overhaul

NNPC’s Group Chief Executive Officer, Bayo Ojulari, recently explained that the refineries will require extensive upgrades beyond current rehabilitation works to meet global fuel quality benchmarks.

He noted that even after repairs are completed, the output from those plants would still fall short of the standards produced by the Dangote Refinery.

“We are redesigning towards high-grade products that satisfy global specifications,” Ojulari said, emphasising that the goal is to make the refineries competitive and commercially viable once they return to operation.

Growing Dependence on Dangote and Imports

With domestic state-owned refineries still offline, Nigeria’s fuel supply is now heavily anchored on Dangote’s private refinery and imported petroleum products.

The November surge highlights how crucial both sources have become for maintaining national availability as year-end demand rises.