Early Life and Upbringing:

Fola Adeola, a luminary in the world of entrepreneurship, was born on January 10, 1954, in Lagos, Nigeria. Raised in a large family with limited resources, Adeola’s childhood involved street hawking to supplement the household income. It was a tough way to grow up, but for Fola, his tough childhood prepared him for his entrepreneurial pursuits.

Adeola’s academic journey was distinguished from an early age. He excelled in his studies, earning a Diploma in Accounting from Yaba College of Technology in 1975. He then trained with Deloitte, Haskins and Sells and D.O. Dafinone & Company, where he was certified as a Chartered Accountant in 1980. Fola has distinguished himself and exemplified his passion for professional education through his training at various institutions, including Harvard Business School, INSEAD, and the International Institute for Management Development in Switzerland.

The challenges of growing up in a developing country and witnessing the socio-economic disparities fueled Adeola’s determination to make a positive impact, motivating him to undertake a one-year research on economic development and job creation policies at the National Institute for Policy and Strategic Studies in Kuru, Jos, Nigeria.

Founding Story:

The genesis of Fola Adeola’s entrepreneurial journey can be traced back to the founding story of Guaranty Trust Bank (GTBank), one of Nigeria’s most successful financial institutions.

Before the idea of starting GTBank, Fola discovered a need in Ikoyi where he lived. Great businesses solve problems, and finding a place to cut his hair was a pressing problem for younger Fola. The only place the Ikoyi residents had to cut their hair was in Mainland Lagos, which was hours away. This didn’t sit well with Fola. One Sunday, he witnessed an accident on the Eko bridge, and that was when he and his long-time friend, Tayo Aderinokun, decided to start a salon in Ikoyi. Their salon, Finishing Touches Barbing Salon, thrived for years and helped Fola and Tayo discover their shared passion for business risks. However, they sold the salon years later to focus on the Infant Guaranty Trust Bank.

At the ages of 34 and 33, Fola and Tayo applied for a banking license in 1988, bringing about 40 friends into the fold, including Femi Pedro, Bode Agusto, Moses Ochu, Gbolade Osidobu, and Akin Akintoye. After countless meetings in Fola’s residence and Tayo’s First Marina Trust Office, the required capital for the new venture was raised. On August 1, 1990, the then Federal Minister for Finance, Chief Olu Falae, issued and signed the banking license No. 58 for Guaranty Trust Bank.

This was an unimaginable feat achieved by a group of young boys in their 30s. The bank broke even in record time and was listed on the Nigerian Stock Exchange in 1996.

This success was due to the fact that Guaranty Trust Bank identified and filled a gap in the banking sector. The existing financial institutions were perceived as slow, bureaucratic, and disconnected from the emerging needs of the Nigerian populace.

The institution was built on the principles of efficiency, transparency, and customer-centricity. This disruptive approach marked the beginning of Adeola’s impactful journey in the world of business.

After 12 years as CEO and managing director, Fola Adeola voluntarily retired from Guaranty Trust Bank on July 31, 2002. His friend and co-founder, Tayo Aderinokun tookover as CEO.

Fola Adeola ( MD/CEO GTBank ) & Tayo Adenirokun (DMD GTBank)

Early Failures and Lessons Learned:

Like many successful entrepreneurs, Fola Adeola faced his share of setbacks. The early days of GTBank were not without challenges. The scepticism from traditionalists in the banking sector, coupled with the volatile economic climate of Nigeria, presented formidable obstacles.

However, Adeola’s resilience and ability to learn from failures proved instrumental. The setbacks served as catalysts for innovation and strategic refinement. The experience honed his entrepreneurial instincts, teaching him the importance of adaptability and calculated risk-taking.

Business Acumen and Innovation:

Vision and Mission:

At the core of Adeola’s entrepreneurial journey was a clear vision and mission. His vision was to establish a financial institution that would not only provide traditional banking services but also become a catalyst for economic development. Adeola envisioned GTBank as a force for positive change, fostering financial inclusion and empowerment in Nigeria.

The mission was twofold – to offer innovative banking solutions and to contribute significantly to the socio-economic development of Nigeria. Adeola believed that a thriving economy required a robust and dynamic banking sector, and GTBank was positioned to be a key player in this transformation.

Business Model and Strategy:

GTBank’s business model was a departure from the conventional banking practices of its time. Adeola and Aderinokun introduced a technology-driven approach, streamlining processes and prioritizing customer satisfaction. The bank leveraged emerging technologies to enhance efficiency, embracing the concept of electronic banking long before it became mainstream.

The strategy was to create a seamless and accessible banking experience for customers. GTBank’s innovative use of ATMs, internet banking, and mobile banking services set a precedent in the industry. This commitment to technological advancement not only attracted a new generation of customers but also positioned GTBank as a trailblazer in the financial sector.

Key Decisions and Risk-Taking:

Several key decisions marked Adeola’s tenure as the CEO of GTBank and calculated risks that played a pivotal role in the bank’s success. One such decision was the focus on corporate and retail banking, a strategy that diverged from the prevailing emphasis on corporate banking alone. This shift allowed GTBank to tap into a broader market segment and establish a strong retail banking presence.

Additionally, Adeola spearheaded strategic partnerships and collaborations, both nationally and internationally. These alliances facilitated the bank’s expansion and diversified its offerings. The calculated risks taken by Adeola and his team, such as entering new markets and embracing cutting-edge technologies, positioned GTBank as an industry leader.

Leadership Style and Values:

A combination of vision, decisiveness, and inclusivity characterized Fola Adeola’s leadership style. He was a visionary leader who set ambitious goals for GTBank and inspired his team to achieve them. His commitment to transparency and integrity became the bedrock of the company’s culture.

Values such as accountability, innovation, and customer-centricity were deeply embedded in the fabric of GTBank under Adeola’s leadership. He believed in leading by example, fostering a culture where employees were encouraged to think creatively and take ownership of their responsibilities.

Building and Managing Teams:

Adeola understood the importance of building a talented and motivated team to execute his vision. His approach to talent acquisition involved identifying individuals who not only possessed the necessary skills but also shared the values and ethos of the organization.

The emphasis on continuous learning and development within the company contributed to a skilled and adaptable workforce. Adeola’s ability to delegate responsibilities effectively and empower his team members to take ownership played a crucial role in GTBank’s sustained growth.

Impact and Legacy:

Economic and Social Impact:

Fola Adeola’s contributions to the Nigerian economy through GTBank are substantial. The bank played a crucial role in facilitating economic growth by providing financial services to diverse sectors. GTBank’s support for small and medium-sized enterprises (SMEs) contributed to job creation and entrepreneurship.

Adeola’s commitment to corporate social responsibility is evident in the numerous initiatives undertaken by GTBank, including educational support, health programs, and community development projects. The bank’s impact extends beyond financial services, positively influencing the lives of individuals and communities.

Beyond Banking: The Heart of a Philanthropist and Family Man

While Fola Adeola’s name is synonymous with Nigeria’s banking revolution, his impact extends far beyond the realm of finance. Adeola’s heart beats with boundless generosity, evident in his extensive philanthropic work and the deep-rooted values he cultivates within his family circle.

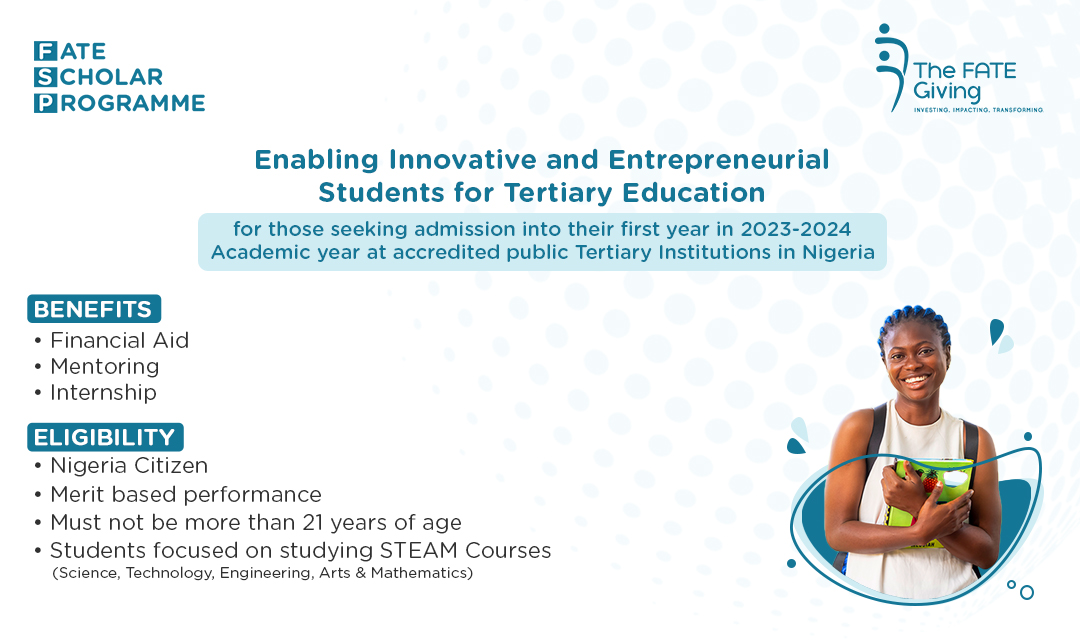

Adeola’s commitment to social good began long before his financial successes. Witnessing the struggles of aspiring entrepreneurs ignited a passion within him to create a platform for empowerment. In 2001, this passion materialized as the FATE Foundation, a non-profit organization designed to nurture the seeds of entrepreneurial potential in Nigeria.

FATE is more than just a grant-distributing body; it’s a cradle of mentorship and guidance. Aspiring entrepreneurs receive comprehensive training, access to networks, and ongoing support, transforming their dreams into tangible businesses. The impact of FATE is undeniable, nurturing over 65,000 entrepreneurs who have created over 80,000 jobs and contributed significantly to Nigeria’s GDP.

But Adeola’s philanthropic reach extends beyond FATE. He has served on the boards of institutions like the Mandela Institute for Development Studies and the World Economic Forum’s Global Advisory Committee on Philanthropy, lending his expertise and passion to causes close to his heart. His advocacy for good governance and social justice reflects a deep-seated desire to see Nigeria prosper not just economically but ethically and equitably.

Influence and Inspiration:

Fola Adeola’s success story has become an enduring source of inspiration for aspiring entrepreneurs and business leaders. His journey from a modest upbringing to the helm of a groundbreaking financial institution serves as a testament to the power of vision, resilience, and innovation.

Adeola’s influence goes beyond the borders of Nigeria, as his leadership philosophy and business acumen are studied and admired globally. Many entrepreneurs look to GTBank as a case study in successful disruption and customer-centric business models.

Even after stepping down as CEO of GTBank in 2002, Fola’s legacy continues to inspire. He remains an active figure in the business and social spheres, mentoring young entrepreneurs and advocating for responsible and sustainable development. His story is a testament to the power of hard work, vision, and a genuine desire to make a difference in the world.

Since retiring from the bank, Fola Adeola has headed boards, including Arm Holdings, MainOne Cable Company Limited, and Lotus Capital (where his wife Hajara Adeola is Managing Director/CEO). He also served on boards like Tafsan Breweries and Lagos State University’s Governing Council.

In public service, Adeola’s contributions are notable. He chaired Lagos State’s Disaster Relief Committee after a 2002 bomb explosion. He also served on Ogun State’s Development Trust Fund Committee and a Solid Minerals Committee.

Adeola was part of the World Economic Forum’s Philanthropy Advisory Committee for four years. In 2001, he joined 24 business leaders in Aspen, Colorado. In 2004, British Prime Minister Tony Blair appointed him to the Commission for Africa.

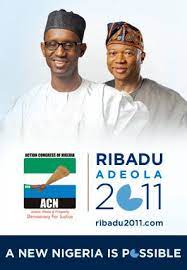

Fola Adeola was the Vice Presidential candidate alongside Mallam Nuhu Ribadu for the Action Congress of Nigeria in the 2011 election. He has received several awards, including distinguished Officer of the Order of the Federal Republic (OFR)

Personal Life and Interests:

Beyond the boardroom, Fola Adeola’s personal life offers a glimpse into the values that shaped his professional journey. Known for his humility and unassuming nature, Adeola maintained a balanced life. His commitment to family, education, and community service mirrored the values instilled in him during his upbringing.

Adeola’s interest in education manifested in his involvement in various educational initiatives. He recognized the transformative power of education and actively supported programs aimed at improving access to quality education in Nigeria.

Family: The Anchor in the Storm

Despite his vast accomplishments, Adeola finds his true haven in the bosom of his family. Married to his sweetheart, Adeola remains devoted to his wife, Hajara, and their six children. Family dinners filled with laughter and lively discussions are his sanctuary, a reminder of the simple joys that true wealth cannot buy.

Friends describe Adeola as a man of genuine warmth and humour. He cherishes long-standing friendships built on mutual respect and shared values. He often hosts informal gatherings at his home, bringing together diverse personalities from the fields of business, academia, and the arts. These gatherings are not about power plays or networking; they are about genuine connection, intellectual stimulation, and the simple joy of human interaction.

Mrs Hajara Adeola

Comparisons and Contrasts:

In comparing Fola Adeola with other successful entrepreneurs, his commitment to ethical business practices and social responsibility stands out. While driven by profit, Adeola emphasized the importance of conducting business with integrity and contributing to societal well-being.

In contrast to some contemporaries who pursued aggressive expansion at any cost, Adeola’s approach was characterized by strategic growth and sustainability. This deliberate focus on long-term stability distinguished him in a landscape often marked by rapid but unsustainable success.

New Business Interest

Mr Fola Adeola due to his vast business acumen has set up other successful ventures currently making wave in the African and world business circle eg Lotus Capital Limited owners of Lotus Bank, lagoon hospitals etc where he is on the board and Mrs Hajara Adeola is currently the CEO. In 2002, after Mr Fola Adeola voluntarily retired from Guaranty Trust Bank, after twelve years, handing over to his deputy, Tayo Aderinokun. Since then he has served as the chairman UTC, ARM, Lotus Capital, Eterna Oil, CardinalStone Partners Limited, Tafsan Breweries (board member), and Credit Registry Services. Fola Adeola is Chairman of Main One Cable Company Limited, owner-managers of the first open access submarine cable in West Africa. and also Union Bank,s insurance Company, Union Assurance.

Honours and Awards

He was nationally decorated as Officer of the Order of the Federal Republic (OFR) in December 2002 by President Olusegun Obasanjo. He has an honorary doctorate from Nkumba University, Ntebbe, Uganda.

Fola Adeola Bags CIBN Fellowship Award

Conclusion: A Life Stitched with Purpose

Fola Adeola’s journey from a young Nigerian to the founder of one of Africa’s leading banks is a narrative of resilience, innovation, and impact. His ability to navigate challenges, his commitment to ethical leadership, and his vision for a transformed banking sector have left an indelible mark on the business landscape.

Fola Adeola’s life is stitched with the threads of business acumen, unwavering philanthropy, and unwavering devotion to family and friends. He is a man who has scaled the heights of financial success yet remains grounded in humility and humanity. His story is a testament to the power of one individual to not only shape the economic landscape of a nation but also to leave a lasting legacy of empowerment, compassion, and love.

As Nigeria continues to evolve as a hub of economic growth and technological innovation, Fola Adeola’s legacy serves as a guiding light for the next generation of entrepreneurs. Through GTBank, he not only reshaped the financial sector but also demonstrated the potential for businesses to be catalysts for positive change. The story of Fola Adeola is a testament to the transformative power of visionary leadership and the enduring impact of a well-executed entrepreneurial vision.