PayPal Holdings Inc.- the leading global payment company seems to be enjoying the huge adoption of e-commerce platforms prevailing globally amid the COVID-19 era, on the basis it recorded impressive Q3 earnings. But, its stock price value dropped extensively after trading on Monday, when the tech payment brand Q4, 2020 earnings outlook came out unimpressive.

PayPal is anticipating that its holiday quarter earnings growth would range at around 17% to 18% growth in Q4 adjusted earnings per share, which results in 97 cents to 98 cents. Stock analysts were predicting $1.07 in adjusted earnings per share.

At the timing of drafting this report, PayPal shares were down 5.77% after trading, as its share price stood at $177.

Highlights of PayPal Q3 earnings

- Total Payment Volume (TPV) of $247 billion, grew by 38% on a spot and 36% on an FX-neutral basis (FXN).

- Posted revenue of $5.46 billion, growing 25% on a spot and FXN basis.

- GAAP EPS of $0.86, up 121% and non-GAAP EPS of $1.07, up 41%

- 15.2 million Net New Active Accounts (NNAs) added, ended the quarter with 361 million active accounts.

- That said, PayPal’s cash, cash equivalents, and investments totaled $17.6 billion as of September 30, 2020.

- The payment company also generated cash flow from operations of $720 million – declining 34%, and free cash flow of $479 million – declining 48%.

- Year-to-date, PayPal has generated cash flow from operations of $4.6 billion – growing 40%, and free cash flow of $4.0 billion – growing 43%.

The earnings result came shortly after PayPal announced it would begin letting users buy, sell, and shop with cryptos through its popularly known platform.

“As we look across the landscape, there are digital currencies, like cryptocurrencies and new emerging currencies like central bank digital currencies.

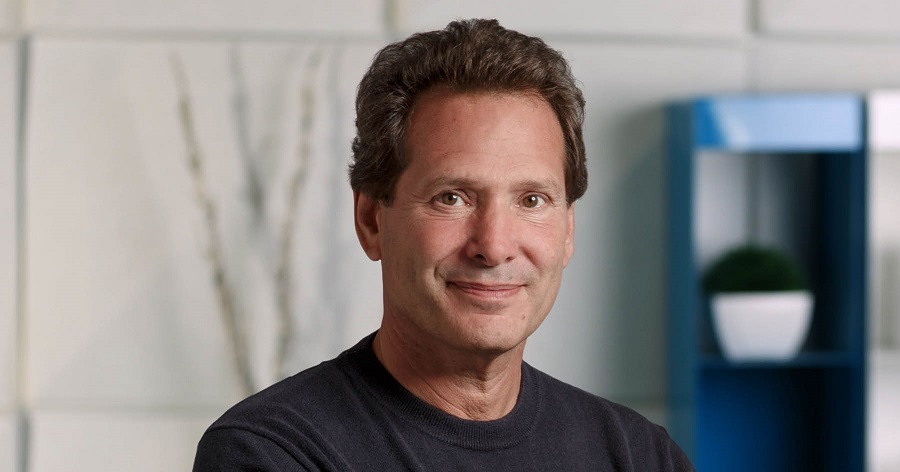

“All of them are clearly complemented by digital wallets and we think our working hand-in-hand with regulators can really usher in a new era around all forms of digital currencies,” Dan Schulman, CEO of PayPal told MarketWatch on Monday.